A real Share Trading Transaction.

A while back I wrote an article asking if Share Traders have the nerve to Buy and wait, no matter what. If I am talking about the odd three hundred dollars I would image the trader would quite comfortably wait out any peak and trough. But, what if it a thousand, five thousand, ten thousand?

Some trader have a Stop-Loss which basically means they ‘bail’ on their trade and sell at a loss. The idea is that they don’t blow their entire budget and live to fight another day. Other traders (like myself) are okay waiting for any correction and will bide their time on other trades. Note: This is why I advocate having three to four trades going at any one time. There will always be that ‘one trade’ likened to the Little Train That Could. It chugs along, loses steam, slides back and then finally steams ahead to the destination.

PART 1

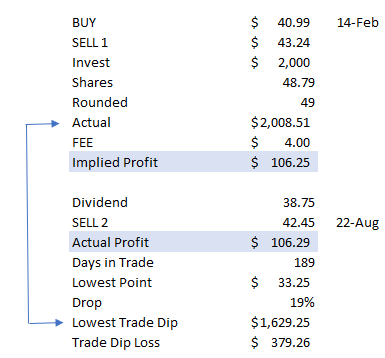

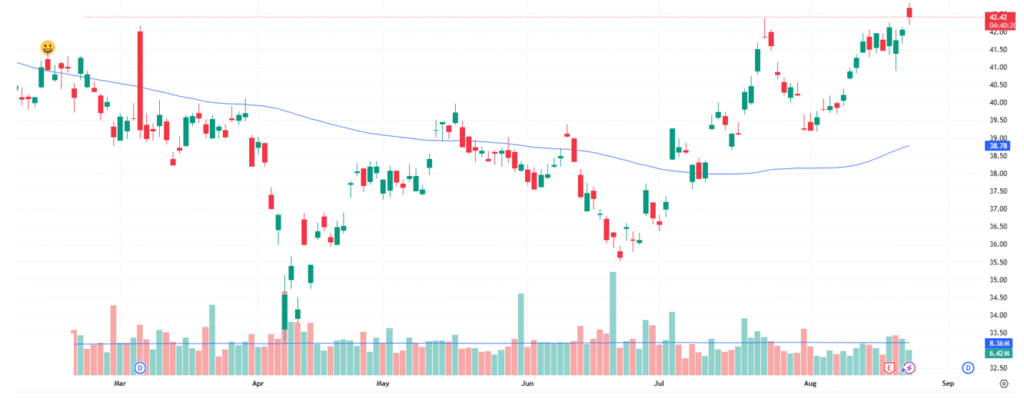

When I wrote Part 1 of this article I attached a snap-shot of a BHP trade I commenced (14 February) and have now sold. This is a perfect example that indicates how long a typical trade might run. Waiting the right price isn’t sexy but it should beats leaving your money in a bank at zero interest. This particular trade took 189 days to complete. I have an example of how this might play out for someone on a budget below:

Now, there are a few things here to unpack. SELL1 is the original sell price to make a profit of 5.5%. It changed to SELL2 price because in March I received a DIVIDEND and therefore I deduct the dividend from the profit, readjust the sell price to maintain the 5.5%.

As you can see, I bought the stock where the smiley face is and rode the roller-coaster to the finish line. In April the share price dropped to $33.25 which in this example meant my balance dropped from $2008 to $1629, a $379 drop. Do share traders have the nerve? This is where the Phycology of trading comes in. I always have the confidence I have picked the right stock, so I am equally confident that what drops, shall also rise. As I said, this trade took 189 days, however my average would be approximately 30 days.

As a Trader for the past fifteen years, I have honed my craft and have the confidence to buy and wait and as of this date, have not had to sell a trade at a loss. Obviously, there are reasons for this as I have written in other articles. The most important one is I only buy shares from the S&P100.

Let me know how your strategy is doing.

Leave a Reply